Chemical market intelligence software for global enterprises

Chemical markets don’t just move—they signal. Valona’s market & competitive intelligence platform lights up patterns forming across supply chains, regulations, and competitive activity — so you can act before the market reacts.

The intelligence platform that's fluent in chemistry

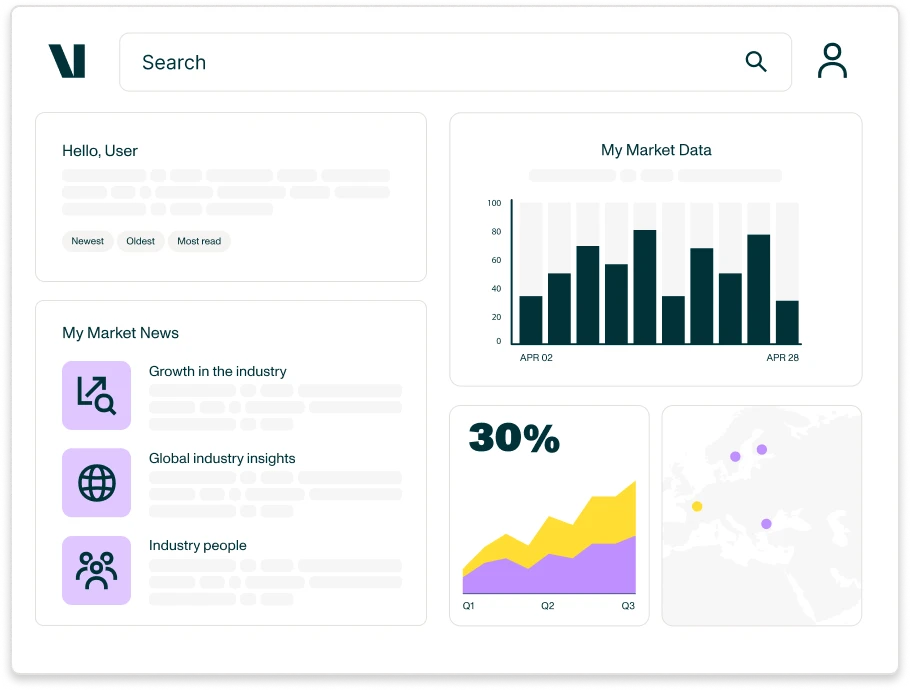

One platform. Real-time alerts. Role-based dashboards. An AI assistant that knows chemicals. Finally, an intelligence platform that’s built for how your team works.

Many inputs. One clear view.

No more ‘which report is right?’ Valona creates one living source of intelligence that updates in real-time. Every team—from R&D to sales—sees what they need, when they need it. Everyone moves together.

How chemical industry leaders use Valona

What happens when the right intelligence lands on the right desk at the right time?

-

For the Commercial Director:

“Swedish committee notes revealed upcoming sustainability regulations. Refined our market analysis to anticipate shifts in customer demand and positioned us as a proactive strategic partner. Won €30M in new contracts.”

-

For the Head of Regulatory:

“PFAS restrictions spotted in EU discussions 18 months before enforcement. We were able to reformulate early and gained 8% market share from unprepared competitors.”

-

For the VP of Supply Chain:

“Japanese trade journal mentioned phenol plant maintenance. Secured alternative suppliers in January. When the March shortage hit, we were the only company still running.”

-

For the Chief Strategy Officer:

“Continuous monitoring and market analysis revealed competitors ignoring sustainable coatings in Eastern Europe. We moved fast enough to capture three new market segments worth €45M.”

-

For the R&D Director:

“Korean language sources revealed the bio-based shift 8 months before Western media. Pivoted our polymer roadmap and launched while our competitors were still studying ‘evolving customer preferences.’”

-

For the Market Intelligence Manager:

“Valona handles the ‘Can you look into this real quick?’ requests from other departments so I can do real intelligence work. Like catching that methylamine risk before it cost us $2M. Now I’m in every strategy meeting.”

FAQs

01 What makes chemical market intelligence different from other industries?

Chemical market intelligence requires connecting signals across complex global supply chains, strict regulatory environments, and long development cycles that other industries don’t face. While general business intelligence focuses on quarterly trends, chemical intelligence must track raw material availability months in advance, monitor regulatory changes across multiple regions, and identify innovation patterns that take years to commercialize. This complexity demands specialized intelligence platforms that understand industry-specific patterns.

02 Why do chemical companies need real-time market intelligence?

With the world spinning faster than ever, supply chain disruptions, regulatory changes, and competitive moves can impact chemical operations within weeks. Real-time intelligence helps chemical companies secure alternative suppliers before shortages occur, adapt to regulatory changes before compliance deadlines, and identify market opportunities while competitors are still processing yesterday’s news.

03 How is Valona’s market intelligence platform tailored for the chemical manufacturing industry?

Valona’s market intelligence software is purpose-built for chemical manufacturers with three key advantages:

1. We’re already track hundreds of chemical companies and industry topics with monthly updates, delivering continuous insights without setup time.

2. Our source base includes chemical industry trade media, industry associations, regulatory agencies, and specialized research sources for comprehensive, relevant coverage without manual work.

3. Our chemical industry taxonomy automatically organizes real-time insights using a four-level categorization system, helping you quickly find what matters most to your business.

04 What are the top competitive and market intelligence use cases for the chemicals industry?

Three key market intelligence use cases are:

Market Trend Analysis: Chemical manufacturers need to stay on top of market shifts, particularly in fast-moving or highly specialized areas, where demand can change rapidly and supply disruptions can have cascading effects. Connect sustainability and consumer trends to product development to ensure your offerings remain competitive and aligned with market needs.

Competitor Monitoring: Link R&D activity with facility investments to anticipate market entry, identify capacity expansions that signal aggressive positioning, and uncover potential acquisition targets before they become widely known. Additionally, monitor competitor capacity issues, which could present opportunities for your business to capitalize on gaps in supply or service.

Regulatory Foresight: Monitor global regulatory changes, track regional trends that create new market opportunities, and turn compliance into a competitive advantage by adopting a proactive strategy.