Global EV trends 2024: When will electic vehicles be widespread?

EVs will eventually replace the combustion engines and bring enormous opportunities to various industries. Here's how.

Not long ago, EVs were niche.

Nowadays, they’re everywhere, and they’re shaking up other industries along the way.

Here’s what we’ll cover in this market dive on EVs:

- EV Market Growth

- Growth drivers and barriers

- Transitioning from combustion engines

- Effect on auto part manufacturers

- Power grids and renewable energy sources

- Effect on logistics

- Conclusion

EV market growth

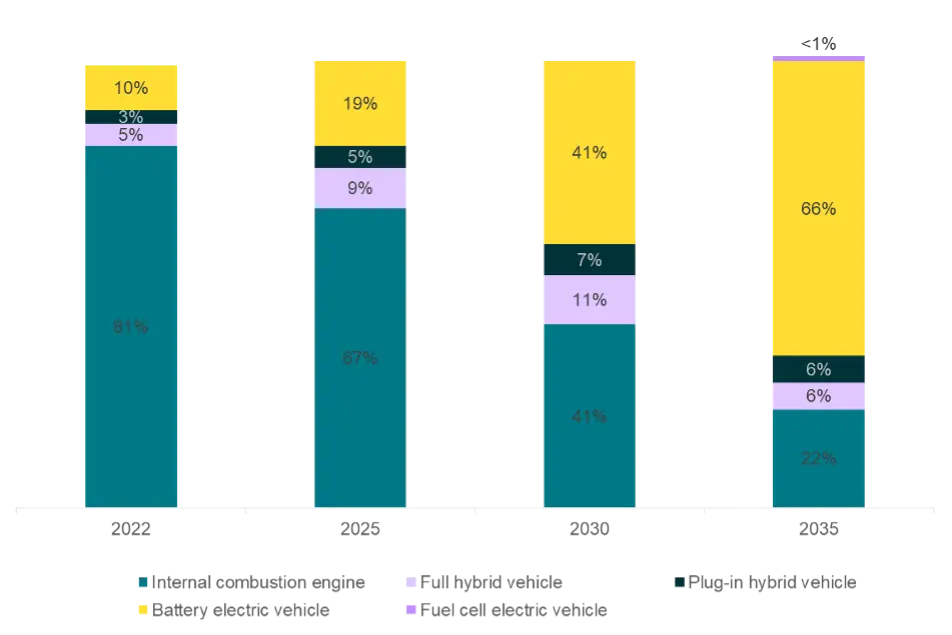

Global EV sales forecast, %

Source: BCG

EVs have been growing significantly in the last few years: sales doubled in 2021, reaching 6.6 million units. In 2022, sales exceeded 10 million vehicles and this number only grew by another 35% in 2023, reaching 14 million units.

The trend is expected to remain strong in the long run, accounting for 66% of total vehicle sales globally in 2035. Along with this trend, it is predicted that combustion engine vehicles (including diesel and gasoline) will reduce their share from 81% in 2022 to 22% in 2035.

The top 5 countries that had the highest percentage of electric vehicles in 2022 (as a share of passenger vehicle sales) were Norway (79.5%), Iceland (40.6%), Sweden (31.8%), the Netherlands (23.9%), and China (21.6%).

Growth drivers and barriers to EV adoption

Both governments and OEMs promote EVs. In addition, consumers are demonstrating a greater interest in EVs.

The key barriers to EV adoption, particularly charging stations, charging time, range, and cost, are being tackled, promising high potential growth for EVs!

Growth drivers: EVs are supported by many stakeholders

- Government policies are promoting EV adoption by ending mass production of gas-powered cars in the US by 2035 and phasing out combustion engines in the EU by the same year. Various governments have introduced subsidiary programs, including incentives for private EV purchases, EV charging, and tax exemptions on new energy vehicles, as seen in China.

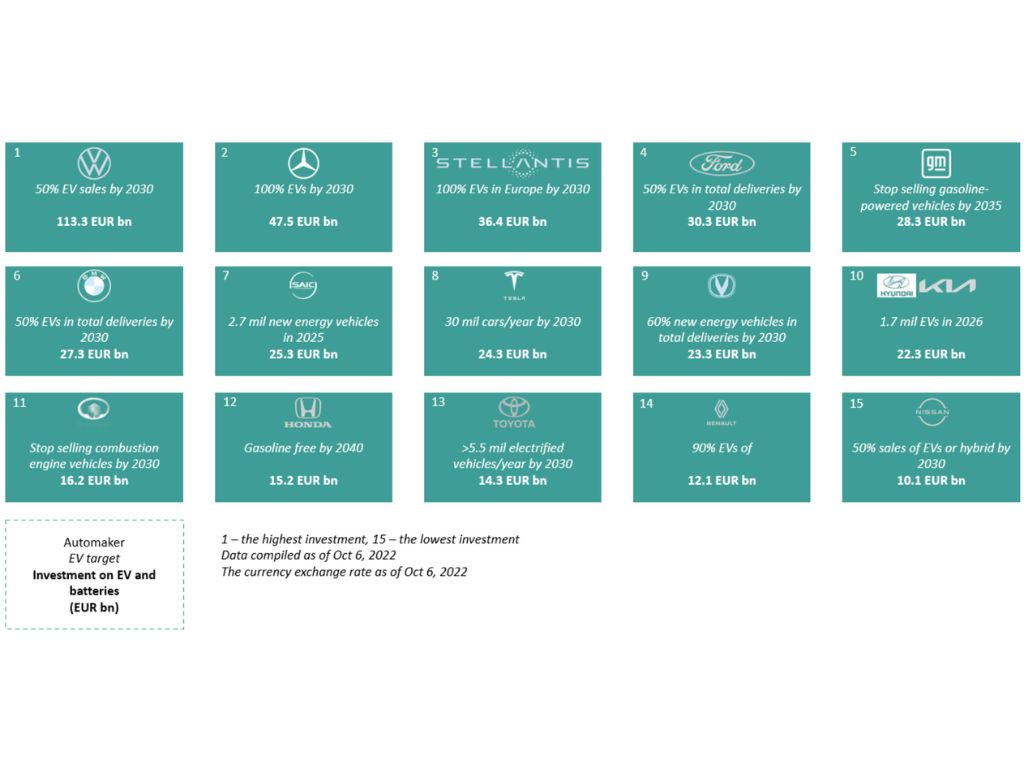

- EMs are forced to comply with local legislation to reduce their carbon footprint. For example, electrified vehicles will take up a planned 50% share of the total deliveries by BMW in 2030, and the carmaker claims to reach this figure well ahead of the target year. Mercedes Benz, with a more ambitious plan announced in 2021, aimed to move its entire product portfolio to EVs in 2030, but in 2023, the company announced that it did not expect its sales in Europe to be all-electric by 2030 but would have its line-up ready. Stellantis intends to sell 100% EVs in the same year. Besides European OEMs, Chinese players are also pushing EV sales. Great Wall Motors will stop selling combustion engine vehicles, and Changan will opt for 60% of new energy vehicles in total deliveries by 2030.

Sources: Reuters, Electrek, Insideevs, Nikkei, Performancemag, NYtimes, Toyota, Arenaev, France-24, Business-standard

3. The heightened awareness of consumers is the third factor that favors EVs. According to Ipsos, a market research firm, in 2022, users will be more interested in EVs than ever before; they believe that EVs will have better performance than the combustion engine, will be more environmentally friendly, and will bring greater economic benefits.

Growth barriers: Charging facilities, time, range, & cost

There are four main factors that make EVs less appealing to many consumers.

These are:

- Charging Facilities: To meet EU climate goals and increased EV demand, 3.4 million public charging points are needed by 2030, costing over €240 billion. However, only 2,000 are being installed weekly, far short of the projected 14,000 by the ACEA. Additionally, the majority of these stations are in Germany, the Netherlands, and France, with ten countries lacking any, making long-distance travel challenging. The US faces a similar problem, with only 50,000 of the projected 500,000 charging units operational, just 10% of the 2030 target.

- Range: Credible sources such as EU Energy and Transport and Autonomy confirm that ‘range anxiety’ is a major concern for car users. To combat this, leading manufacturers like Volkswagen, BMW, Stellantis, and Ford are delving into wireless charging methods, including dynamic charging while driving. This innovative approach is expected to launch between 2028 and 2029.

- Charging Time: Electric charging currently takes longer than refueling traditional internal combustion engine (ICE) vehicles, varying from 20 to 50 minutes at fast charging stations to overnight charging at home. Initially, the aim was to match the speed of traditional fueling, but the perspective has changed. Aaron Fishbone from ChargeUp Europe suggests treating EV charging like charging smartphones, plugging in whenever possible.

- Cost: Many consumers still perceive EVs as expensive. In the US, 75% expect to pay around $50,000 (€50,589) for an EV, but the actual average price is approximately $75,398 (€76,267), 51% higher than expected. In March 2023, the average price for a new vehicle was $48,008, while the average EV cost $58,940, making it roughly 23% more expensive. However, regions like the US offer incentives such as tax reductions or subsidies to make EVs more affordable. Additionally, Asian players and startups promise to launch more economical EVs at around €30,346. Key players like Volkswagen, Honda, and Nissan also plan to introduce lower-priced EV options.

“When will EVs be more widespread than traditional combustion vehicles?”

Based on continuous tracking and our tight relationships with automotive experts, Valona Intelligence believes that EVs (battery electric vehicles and plug-in hybrid vehicles) will be widespread in 2030–35, mainly in Europe and the US.

The possible impact of EVs on industries

The automotive industry has felt the impacts of the rise of EVs, and so have other industries. Insights about the effects of EVs on the automotive industry and other key industries, namely auto parts, the power industry, and the logistics sector, are noted below.

Transitioning from combustion engines

Many, if not all, OEMs have publicly announced goals for fully electrified lineups at some point (soon) in the future. However, they still need sales of internal combustion engine (ICE) vehicles, at least in the short run, to support the capital-intensive yet barely profitable EV business. On average, EVs are still 45 percent more expensive to build than ICE cars.

Automakers must determine how much they can use their existing internal combustion engine (ICE) production lines for EVs. While establishing a new factory can be costly, converting existing ICE platforms to EV ones can compromise performance and driving range.

Automakers also must make the challenging decision of whether to manufacture or purchase key EV components. If they opt to manufacture, they may need to quickly collaborate with new suppliers or consider mergers and acquisitions.

In any case, traditional OEMs are losing the economies of scale advantage they have had with the ICE vehicle business model.

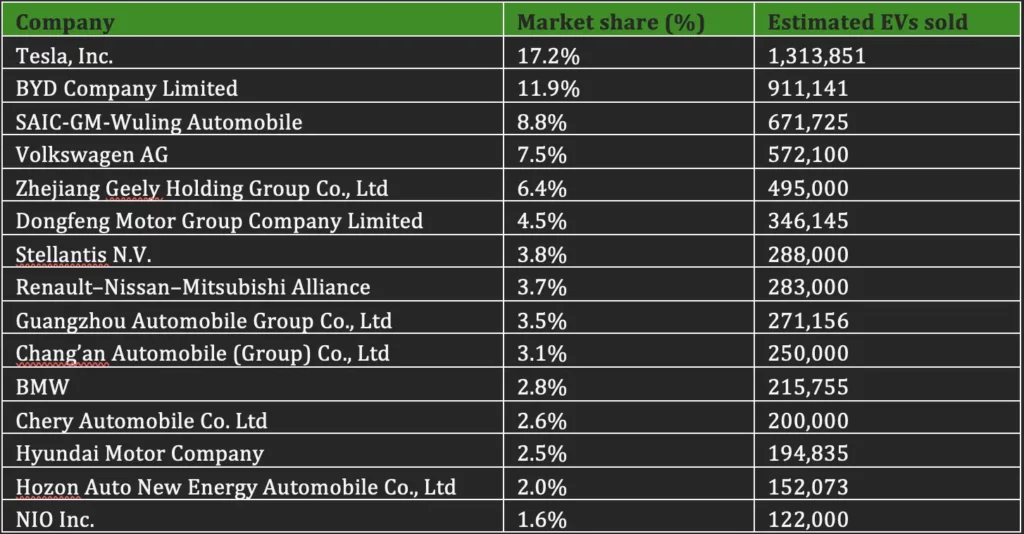

They have to face a new reality that start-ups with no automotive experience, such as Tesla, can successfully step into the EV landscape. Besides, Chinese players, being newcomers, are now chasing after “traditionally leading OEMs”. BYD is ahead of VW in this EV game so far!

Global EV market share by companies in 2022, Top 15 companies

Source: Insider Monkey

No one can tell which companies will be the leaders when EVs become the dominant vehicle technology. What we know with certainty is that all players are encountering challenges with high production costs, limited EV infrastructure, and heavy competition. To stay in the game, it is vital to adopt a flexible and agile approach and continuously monitor the market.

Effect on auto part manufacturers

Electrification is also disrupting the auto parts market. New components and products, such as the battery pack or EV charging infrastructure, shine. Others, such as automotive wiring, must go through some transformation. Meanwhile, the future of components only used in ICE vehicles does not look bright.

From their original position as one of the least interesting components, batteries are now a star and the most expensive component in an EV in this EV era. The global electric vehicle battery market is predicted to reach EUR 156.4 billion in 2028 from EUR 22.2 billion in 2020, at a CAGR of 28.1% during the forecast period.

The five dominant battery manufacturers are CATL (29% of the 2023 global EV battery market share), LG Energy Solution (20%), BYD (19%), Panasonic (10%), and SK Innovation (7%).

Bolstered by government investments in battery technology, newcomers are more and more eager to enter the battery market.

The development of safe and efficient battery technology is a complex, time-consuming process. The prices of essential raw materials such as lithium, cobalt, and nickel are also on the rise. Therefore, while the demand for batteries is undeniably growing, careful and ongoing evaluation of profitability factors is crucial.

European OEMs, such as Volkswagen, BMW, Mercedes Benz, and Stellantis, are moving battery manufacturing closer to home to secure the supply and reduce the carbon footprint that is inherent in transportation. There will be at least 40 Gigafactories and 21 battery assembly plants built in Europe—Germany is the top location with 12 gigafactories.

The EV charging infrastructure is a crucial element to sustainable electrification. Home charging alone is not enough to boost EV adoption.

Many initiatives have been established to enhance the availability and convenience of publicly accessible chargers. According to Uswitch.com/electric-car, the Netherlands is the best country for EV drivers, with 24.15 charging stations per 10 km2 on average.

Electric road systems may grow out of their infancy stage soon. In 2013, South Korea already tested the world’s first road-powered electric vehicle network of 24 kilometers. Sweden recently announced plans to open the world’s first permanent electric road in 2025.

Wiring harnesses, considered the vehicles’ veins, are no doubt one of the most crucial elements in EVs and are receiving great attention from OEMs. EVs promise to offer many entertaining features that can be downloaded and installed per request, like mobile apps. In addition, autonomous driving is being developed aggressively by key players, namely Volkswagen, BMW, and Stellantis.

Wiring harnesses require a huge amount of wiring, adding a potential increase of at least 50% of the current vehicle’s weight, according to an expert’s comments to Valona Intelligence.

Suppliers must provide a solution that helps OEMs reduce the cars’ weight, space, and complexity. New EE architectures, which are believed to simplify the wiring system, making ways for automation, are expected to be implemented shortly. For example, Volkswagen intends to use its Scalable System Platform for the whole product portfolio in 2028–30, with Stellantis and its STLA starting in 2024.

Some of the most active players are Aptiv, Bosch, and Dräxlmaier. The time-to-market for EVs must be shorter than that for internal combustion engine cars—ideally, 12 months to a maximum of 24 months to develop and launch 1 new model, an expert highlighted.

Since the wiring harness industry is an intensive labor sector, it is crucial to speed up the design phase and product testing and enhance production automation.

An EV requires many fewer parts than a comparable ICE one. The entire drivetrain of an EV, for example, needs around 20 moving parts, compared to 2,000 moving parts for an ICE vehicle. Therefore, ICE part manufacturers need to invest in necessary research and development, or collaboration and acquisition, to diversify and remain relevant in the automotive sector over the long run.

Power grid growth and renewable energy sources

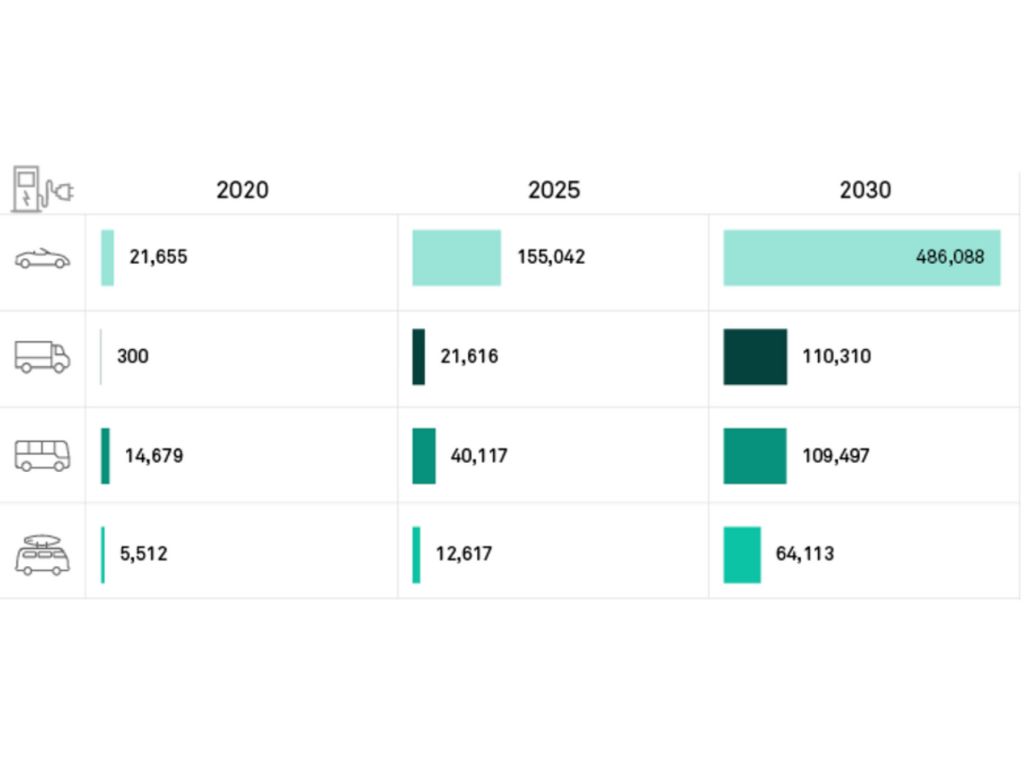

The current power grid can handle all EVs that are purchased in the coming years. According to International Energy Agency, the global electricity demand by selected EVs will increase at a CAGR of 40.3% between 2020 and 2025, reaching 229,392 GWh in 2025. The demand will continue to increase until 2030 at a lower rate, a CAGR of 27.4% between 2025 and 2030.

Global electricity demand by selected EV types (GWh)

Source: International Energy Agency

100% on-road EVs will take time; our personal guess is at least 3 more decades. Hence, power companies have time (if they start investing) to build or upgrade existing power plants.

Renewable energy sources like solar and wind power, as well as new technologies to store and distribute power efficiently, should receive more attention.

In fact, the power and EV sectors will become the new “power couple,” like ICE vehicles and the gas and oil industry have been to this point. Moreover, EVs can be integrated into power grids, thanks to, for example, smart grid technologies, so that EVs can be used as two-way power resources.

Effect on logistics

A growing number of logistics companies are switching to electric trucks to reduce carbon emissions, driven by companies’ own green initiative and/ or government regulations. DHL promised to reduce its net carbon emissions to zero by 2050, and FedEx plans to purchase only EVs by the year 2030. Compared to ICE fleets, EVs are believed to facilitate savings in terms of fuel cost, maintenance cost, and overall operational cost.

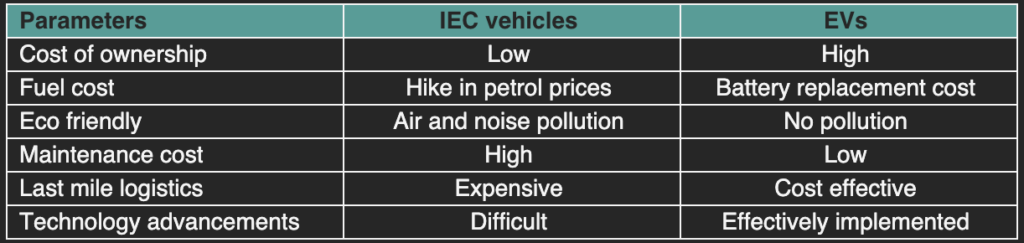

ICE vehicles versus EVs

Source: Esmito

Online commerce platforms are pressured to push the adoption of EVs. Amazon, for example, announced that they will add 100,000 EVs for delivery by 2030 to reduce their carbon emissions.

Conclusion

Unquestionably, EVs will eventually replace the ICE and bring enormous opportunities to various industries, such as electric power and high-voltage battery manufacturing.

Challenges like new consumer demands, technology requirements, and supply chain models are expected. We strongly recommend staying updated on market trends and developments consistently to develop meaningful strategies and stay ahead of the game!

Valona Intelligence provides tailored research projects and continuous news monitoring services. We empower businesses to stay informed, adapt to evolving demands, and maintain a competitive edge.