4 Steps to Market Size Like the Pros

Market sizing and forecasting are essential to market intelligence. They help answer crucial questions about the size and growth rates of any given market.

When conducting market sizing and forecasting, the goal is to chart a path for company growth and make informed decisions about which markets to enter and sustain growth.

Basic concepts in market sizing

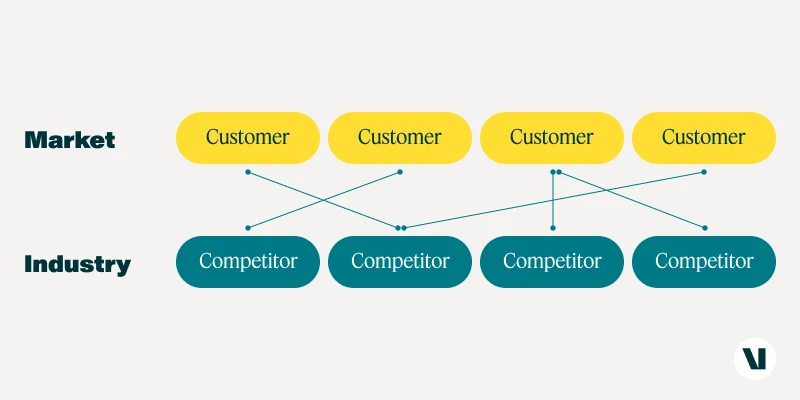

What is meant by ‘the market’? In its most basic sense, ‘the market’ is a group of customers buying a certain product or service from the same or similar sellers.

On the flip side, sellers offering similar products and services make up ‘the industry’. Most industries and markets are part of long chains of buyer-and-seller relationships, spanning from B2B connections to the B2C market.

Market sizing helps you uncover potential

Market size is the total volume or value of products and services that an entire industry can sell to a specific group of customers within a defined timeframe, usually annually.

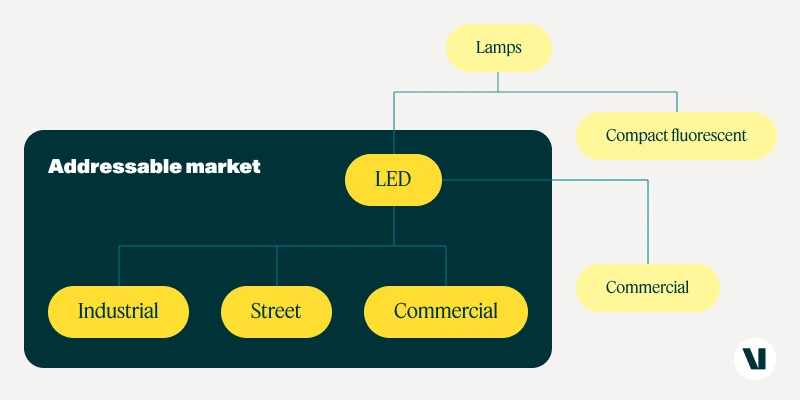

Within the overall market size, there is the addressable market—a specific segment that a company can capture with its offering.

Market sizing is never accurate, but maybe it doesn’t need to be

Accurate market sizing is almost impossible.

There’s a subjective nature to estimation methods, and there’s a significant reliance on assumptions. Moreover, market dynamics rapidly change the size of the market. For example, intensified competition often leads to price declines and corresponding changes in market volume and value.

To make up for the lack of accuracy, it’s important to accept that precise estimates aren’t even necessary. Instead, it’s beneficial to create different forecasting scenarios based on varying assumptions. Remember: it is better to be broadly right than precisely wrong.

The 4 steps of market sizing

Typically, any given market-sizing exercise will follow a four-step pattern:

- Clarify the question and segment the market

- Build the estimation model by breaking the problem down

- Source the data to solve each piece and consolidate

- Validate the results

STEP 1: Clarify the question and segment the market

You want to clearly define the product or service being sized; this is essential. In today’s world, companies always strive to differentiate their offerings. Differentiation makes market sizing very challenging. Because of the ambiguity, you’ll have to make some judgment calls about which products or services to consider as competitors in the same market.

Next, you’ll segment the market to determine the structure of the addressable market. This means breaking down the market by sub-products, applications, customer segments, geographies, and other relevant factors. For example, segmenting the lamp market might involve differentiating technologies (LED, compact fluorescent, incandescent), applications/client segments (industrial, street, commercial, residential), and countries served.

Understanding how market sizing will be used and which segments are crucial for estimation is essential. The cost and time required for data collection are closely linked to the desired accuracy, granularity, and speed of market sizing. If cost and time constraints are high, it’s likely you’ll need to reduce variables or combine categories.

STEP 2: Build the estimation model by breaking the problem down

All methods for estimating market size involve breaking down the problem into smaller parts and combining them to pull out the overall market size. The two principal methods are the ‘top-down approach’ and the ‘bottom-up approach’.

Top-down approach, aka ‘chain ratio method’

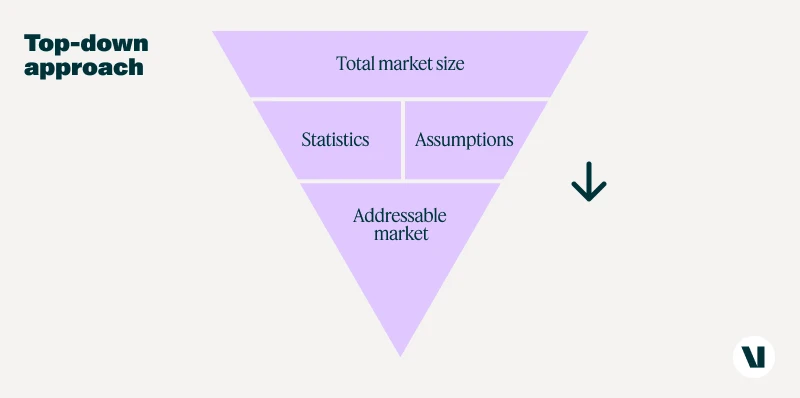

The top-down approach estimates the addressable market from above, by starting with a broad market size figure—like an existing market research report for a bigger segment—and narrowing it down to the target market segments by using assumptions and statistics.

Some assumptions can be verified via existing data or statistics, others cannot and have to rely on the best guess or judgment of the market modeler. The top-down approach is usually considered a less robust methodology. It is the “fast and cheap method” of market sizing and tends to give market estimates that are too high.

Bottom-up approach, aka ‘counting noses’

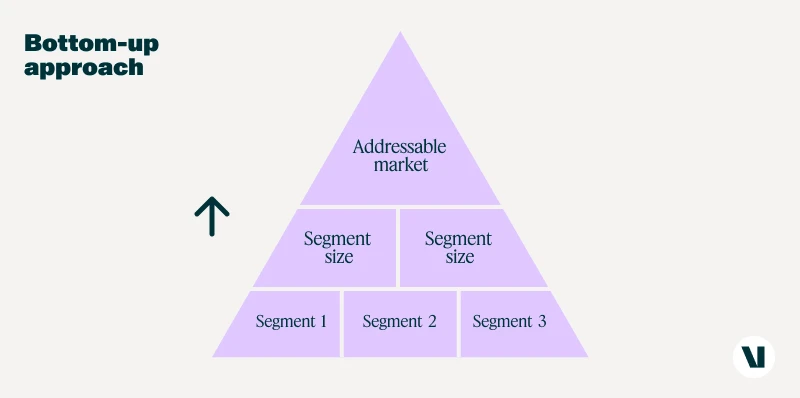

The bottom-up approach estimates the addressable market from below by summing up known data from market participants: usually the supply side or less frequently the demand side.

This approach is often considered more conservative and robust as it takes into account the industry’s capacity limitations. Bottom-up usually requires primary research, making it more accurate but also more costly.

General principles of building the estimation model

To build your estimation model, start by mapping out the available data and comparing it to the product definition and segmentation from step 1.

Then, develop the model by identifying the data gaps and creating a research plan to source the missing data. Use visual aids like flowcharts to assist in understanding the data flow.

STEP 3: Source the data to solve each of the smaller pieces and consolidate into a final result

Secondary and primary research

Sourcing the missing data will take a combination of secondary research, primary research, and analysis.

Secondary research relies on published statistics, existing industry data, product data, news, and company information.

Primary research is conducted through surveys, questionnaires, and expert interviews.

The data collected through these methods is then analyzed.

Analytical tools

Typically, in market sizing, the availability of data can be a major challenge. To bridge the gaps and enhance accuracy, various analytical tools can be employed. Consider using the following methods:

- Heuristic assumptions: Also known as educated guesses or common sense, heuristic assumptions play a vital role in many market studies, even the most highly regarded ones.

- The Delphi method: This judgmental estimation and forecasting method relies on principles like anonymity, iteration, controlled feedback, and weighing. It can provide valuable insights and help with the accuracy of market sizing.

- Regression analysis: By establishing a relationship between an already estimated market size and predictor variables, regression analysis enables quick top-down estimation of additional data points. Predictors can include GDP, demographic and geographic variables, industry production, imports and exports, and the market size of related products or services.

These analytical tools, when applied strategically, can fill data gaps and provide more reliable market estimates.

STEP 4: Validating the results

After gathering the missing data and incorporating it into your model, it’s very important to validate the results to ensure their accuracy.

The validation process consists of two steps:

Thorough checking of the model and inputs

Begin by conducting a quick, comprehensive review of the model you used, including the inputs, assumptions, calculations, and sources.

Pay close attention to the product definitions, segmentation, and other crucial factors. Perform ‘sanity checks’ to ensure the overall coherence and reliability of the model. This is a GREAT time to conduct a sensitivity analysis, where you test the model by using the highest and lowest possible values for uncertain assumptions.

Triangulation – building a model with multiple approaches

Triangulation is a powerful technique where you use two or three different approaches to estimate the same variable. By employing disparate sources of data and independent estimation methods, you’re able to cross-validate your estimates and increase their reliability. Triangulation reinforces confidence in your market sizing results while ensuring consistency in product definition and segmentation.

The validation process should ultimately provide you with the assurance and certainty needed to derive similar market estimates from multiple methods or sources.

What next?

Accurately sizing the market allows you to set growth targets, position your products effectively, and make informed decisions about market entry and expansion. Remember, conducting thorough research and analysis is key to obtaining reliable market estimates.

At Valona, we offer support in market model creation, secondary research, interviews, and analysis.

Discover more about our strategic analysis services and unlock your market potential!