How to measure market intelligence success with KPIs

Companies rely on competitive intelligence to gather and analyze information about their competitors. However, measuring the success of market intel efforts is equally important. This is where key performance indicators (KPIs) come into play.

Staying ahead of the competition is crucial for success.

Intelligence success factors are a tool to help your organization identify and track progress in competitive and market intelligence processes systematically. Valona has meticulously developed them from experience with thousands of projects over the past 20 years.

The key here is monitoring: monitor plans, progress, and outcomes to better understand the business triggers. It’s crucial to monitor your company’s bigger-picture plan and impact to stay innovative in competitive marketplaces.

In this article, we will walk you through the top indicators for success based on the intelligence success factors. This will help you monitor your success using competitive intelligence KPIs and market intelligence KPIs.

We’ll delve deeper into the world of competitive and market intelligence. Valona has decades of expertise in this field. We’ll also introduce the concept of ‘intelligence success factors’ (ISFs) and how they will help you contribute to world-class market intelligence.

ISFs come from Valona’s Intelligence Best Practices.

Intelligence success factor 1: Focus

Intelligence success factors include:

- Focus

- Organization

- Processes

- Tools & AI

- Deliverables

- Culture

Each ISF has a relevant component that allows you to measure and track your progress. Discover exactly how your intelligence function measures up. You’ll notice that these repeat frequently, and that is intentional! Interdependency means you’re holistically evaluating your goals.

Your journey to world class is not linear. It’ll take a holistic approach.

Let’s get started.

Focusing your market intelligence on organizational goals

In every business venture, focus is paramount. Especially in market intelligence, it’s crucial to align your efforts with your organization’s overarching goals. The reason is simple: market intelligence is not about indiscriminate data accumulation. It’s about leveraging that data to drive informed decisions that propel your organization towards its strategic objectives.

To reach new markets, improve customer satisfaction, or boost profits, your market research should be planned to match your company’s focus. This will help you gather the needed information to achieve your goals.

When it comes to measuring the focus of your market intelligence efforts, relevant KPIs include:

Strategic alignment: This KPI ensures that your market intelligence aligns with your company’s goals. For example, if your goal is to target a new demographic, then research on this demographic contributes to this KPI.

Impact on decision-making: How does market intelligence influence strategic decisions? Keep track of the strategic decisions made based on the intelligence you provide.

Goal achievement: Or how market intelligence impacts business success. Set specific goals and track your progress towards them. For example, if your goal is to increase market share, monitor your market share changes.

Suppose a company specializes in medical devices, and they want to enter the pediatric care market. They begin to align their market intelligence efforts towards this goal. To do this, they count every research project involving pediatric care trends, needs, and preferences towards their strategic alignment KPI.

To measure their decision-making impact, they record all strategic decisions within a certain period. If one of those decisions was to develop a pediatric ventilator based on their market intelligence, they would include this in the ratio of decisions influenced by market intelligence.

For goal achievement, set an explicit goal. For instance, capturing x% of the pediatric ventilator market within the first year. Keep track of your progress by monitoring your new product’s market share. If you observe a rising market share, it means your market intelligence, which led to the development of the pediatric ventilator, is effectively contributing to your goal achievement.

Intelligence success factor 2: Organization

Building a robust market intelligence team

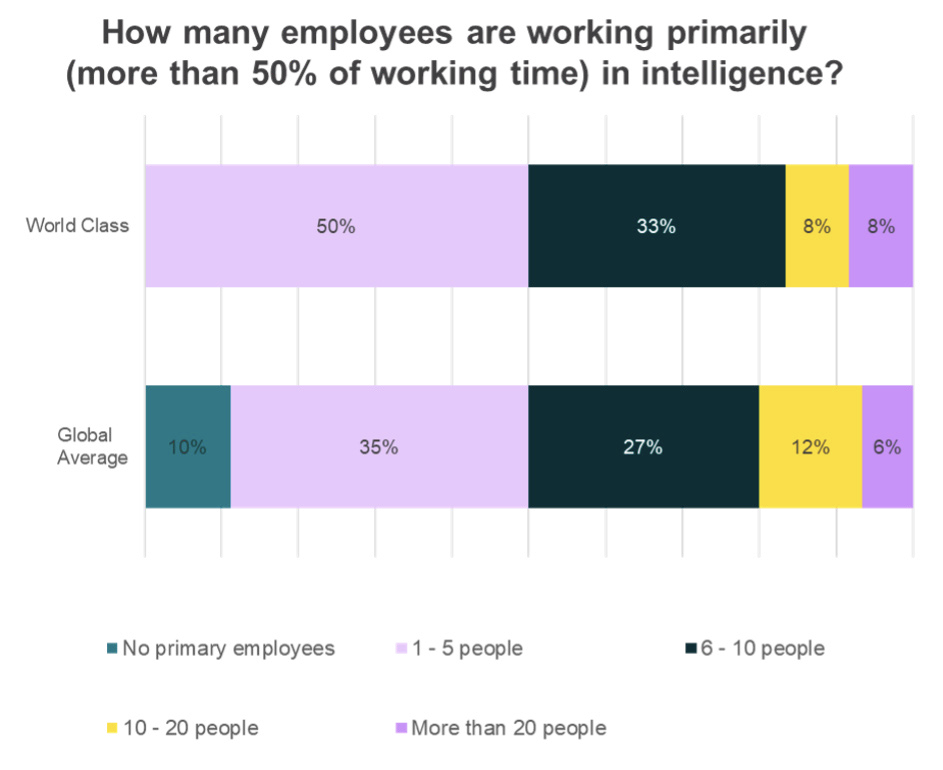

Dedicated teams bring together diverse skills and expertise, so all aspects of market intelligence — from data collection and analysis to reporting and strategic application — are handled competently.

Your team becomes the backbone of your market intelligence function, driving the generation of actionable insights that can inform strategic decision-making and contribute to achieving business goals.

Building a robust market intelligence team is a critical step to the success of your efforts.

Measuring the effectiveness of your market intelligence team is essential for continuous improvement and ensuring that your team’s efforts contribute to your business objectives. Here are some KPIs you could consider:

Efficiency: Basically, the time taken to complete tasks or projects. A reduction in the time taken to complete a market analysis report indicates improved efficiency.

Quality of insights: The relevance of your team’s insights to the company’s goals.

Skill development: This KPI tracks your team’s acquisition of new skills and knowledge. This could involve tracking attendance for training activities or new certifications. Regular skill assessments can also be conducted.

Take the medical device company from the last example. They are forming a dedicated market intelligence team.

To measure efficiency, the company sets benchmarks for how long it should take to complete market analysis reports. If the team starts producing these reports faster than the benchmark time, it signifies improved efficiency.

To assess the quality of insights, the company seeks regular feedback from the research and development teams, who use these insights for product development. They conduct a survey that includes other KPIs as well (including timeliness). If the team finds the insights about medical device trends useful and relevant, it indicates high-quality insights.

Finally, for skill development, the company keeps track of team members attending training sessions or gaining new certifications in areas like data analysis or market research. Regular assessments of the team’s skills can also be conducted to ensure continuous learning and development.

Intelligence success factor 3: Processes

Managing effective intelligence processes

The management of effective intelligence processes is crucial to the success of market intelligence efforts. These processes, which include data gathering, analysis, interpretation, and distribution, form the backbone of your market intelligence function.

When managed well, processes ensure consistency, reliability, repeatability, and timeliness in your market intelligence outputs.

Without well-documented processes, your team could be left navigating in the dark. Clear, simple guides help everyone work towards a common goal. They not only save time but also safeguard the quality of your intelligence and ensure that you’re not left up a creek without a paddle in the event of turnover.

When it comes to CMI, remember that a well-documented process is a crucial step on the ladder to success.

They enable your team to produce high-quality insights that can inform strategic decisions and contribute to achieving business goals. Moreover, effectively managed processes can enhance the efficiency of your market intelligence function, saving time and resources and increasing its overall value to your organization.

To measure the effectiveness of your market intelligence processes, consider the following KPIs:

Process efficiency: Measured by the time taken to complete each stage of the intelligence process. Reductions in this timeframe indicate improved process efficiency.

Quality of insights: The relevance and applicability of the insights generated by your processes show their effectiveness.

Impact on decision-making: The ultimate goal of market intelligence is to inform strategic decisions. Therefore, a key measure of process effectiveness is the extent to which your intelligence outputs are used in decision-making.

Processes ensure consistency, reliability, repeatability, and timeliness in your outputs.

For example, the growing medical device company wants to streamline their market intelligence processes. They have a dedicated market intelligence team, but their methods for data collection, analysis, interpretation, and distribution are inconsistent and time-consuming.

They begin to clearly define each process, assign roles, and set timelines.

They measure process efficiency by tracking the time taken to complete each stage of the process, aiming for a 20% reduction in the first quarter.

They assess the quality of insights through feedback from the users of the market intelligence — for example, the company’s product development team. They use a user satisfaction score, striving to achieve a score above 80%.

Lastly, they quantify the impact on decision-making by tracking the percentage of strategic decisions influenced by market intelligence. If, before the process changes, market intelligence was used in 53% of strategic decisions, the company can set a goal to increase this to 70% after the changes.

These are all solid ways to quantify how processes affect the company’s bottom line.

Intelligence success factor 4: Tools & artificial intelligence

Harnessing technology for efficient market intelligence

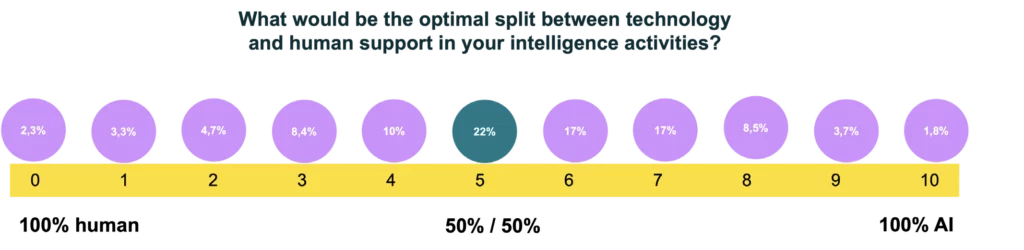

Market intelligence involves gathering and analyzing relevant information for confident decision-making in areas like market opportunity and development. Tools such as data analytics software and artificial intelligence are vital in enhancing this process.

AI has its shortfalls: it’s still pretty bad at sounding like a human when writing content, for instance.

Use tools as an effective shortcut to help understand and share market trends, competitor strategies, and consumer preferences by presenting data in a comprehensible format.

However, right now it’s doing great with machine learning, or quickly handling large data volumes and identifying patterns and relationships not immediately apparent to humans. Processing data is great news for strategic intelligence, as it offers deeper market insights than a person would be able to deduce on their own.

KPIs to measure the effectiveness of these tools could include:

Accuracy of data analysis: This measures how accurate the analysis from the tools and AI is. The higher the accuracy, the more reliable the market intelligence.

Quality of data handling: Or, simply put, how much data can the tool’s AI handle? The more data it can handle, the more powerful the tool.

User friendliness: This measures how easy it is to use the tools and AI. The easier they are to use, the more efficient they will be in a business setting.

Our favorite medical device company has recently integrated AI tools into their market intelligence tech stack.

They start to measure the accuracy of data analysis by comparing the AI’s market predictions with actual market outcomes over a specific period. For instance, if the AI accurately predicted market trends for 18 out of 20 months and were able to back this up with hindsight, the accuracy would be 90%.

The medical device company measures the quality of data handling by assessing the relevance of data input and output. They verify the AI tool’s ability to process diverse, relevant datasets and compare the tool’s results to key performance indicators or objectives. The tool provides data and insights that suggest an opportunity to increase production efficiency by 20%; for example, they start to consider “production efficiency” as the KPI for quality data handling.

Finally, they begin to measure user friendliness via a quarterly survey sent to all stakeholders using the tool. They ask about the ease of use of their intelligence tool, its design, intuitiveness, and learning curve. They then quantify the feedback received to calculate an overall user satisfaction score.

Intelligence success factor 5: Deliverables

Producing quality market intelligence reports

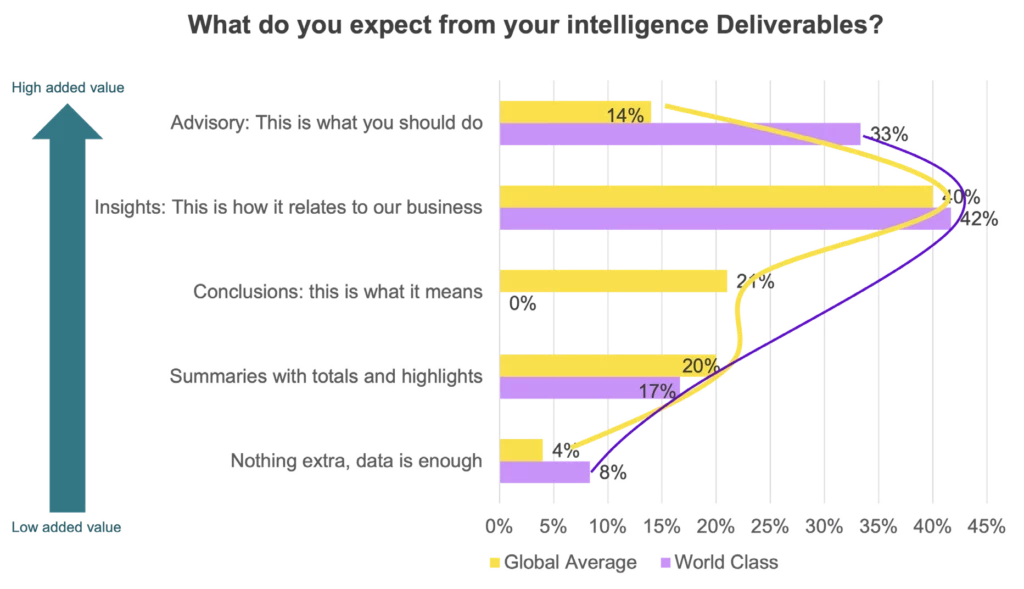

In an ideal world, decisions will be made based on intelligence deliverables. They can significantly impact the strategy and direction of the business.

If the MI you produced is flawed or not timely, it could lead the company down the wrong path, resulting in lost opportunities, wasted resources, and possible financial losses.

Quality market intelligence provides a competitive edge. It can uncover unique insights that competitors might not have, leading to more effective strategies. If your stakeholders notice that the information provided is consistently accurate and useful, they are more likely to trust the company’s decisions and future market intelligence.

So, to measure the success of deliverables, we suggest tracking the following KPIs:

Accuracy: This measures how often the market intelligence is correct.

Relevance: This measures whether the intelligence relates to the company’s specific business needs and goals. If they find the information helpful and applicable to their needs, it is relevant and much more likely to influence beneficial decisions.

Timeliness: Market intelligence is produced and delivered in time for it to be useful.

The medical device company is now measuring KPIs for new reports.

To assess accuracy, the firm compares various reports. They begin to read through last quarter’s reports to gauge predictions. They ask, in hindsight, are the predictions aligned with actual market trends? This requires some digging, but if most predictions were correct, the accuracy would be high.

To measure relevance and timeliness, the MI team solicits feedback from stakeholders, which is also tied to quality. They do this using a generic survey, quantifying results on a Likert scale (1–5, strongly disagree to strongly agree). They conduct this quarterly to measure and compare in the future.

Intelligence success factor 6: Culture

Fostering a supportive market intelligence culture

Nurturing a supportive intelligence culture within an organization is arguably the most important intelligence success factor, as a good MI function is useless without buy-in.

A decent intelligence culture encourages the sharing of information across departments, helping to break down silos and promote cross-functional collaboration. Finally, a strong market intelligence culture can support innovation, as employees are more informed about market trends, customer needs, and competitor activities.

KPIs to measure the strength of your intelligence culture could include:

Utilization: How often (and by whom!) is market intelligence being used in your organization? The wider and more frequent the use, the stronger the intelligence culture.

Impact: Measure impact by documenting the decisions made in your organization and identifying the ones influenced by market intelligence. Calculate the proportion of decisions impacted by intelligence against the total number of decisions, which gives you a clear measure of impact.

The same medical device company aims to foster a culture that values market intelligence. They’ve invested in the right market intelligence tools and have trained their staff to use them. They’ve also established a system for disseminating insights across departments and incorporating market intelligence into their decision-making processes.

It’s our job to encourage colleagues at all levels to value and use MI in their decision-making process, promoting data-driven decisions across the board.

To measure utilization, they conduct surveys asking employees about their usage frequency of market intelligence. High scores for utilization and satisfaction indicate that their intelligence culture is robust. They also find that decisions based on market intelligence are more successful, further validating their strong intelligence culture.

To measure impact, they evaluate how MI and CI activities have influenced decision-making, problem-solving, innovation, and the overall growth mindset within the company.

They began to track the number of strategic decisions and new initiatives directly influenced by MI and CI reports. If their insights informed a significant percentage of decisions, it demonstrates a strong impact on the company’s culture.

In addition, they might measure the frequency and quality of discussions and actions around MI in company meetings, internal communications, and training programs. An increase in these activities indicates a growing culture of intelligence in the company.

Intelligence success factors are your North Star to world-class intelligence

The intelligence success factors — Focus, Organization, Processes, Tools & AI, Deliverables, and Culture — play an integral role in leveraging market intelligence effectively. Each of these factors can be gauged using pertinent KPIs to ensure consistent progress.

Our team has developed an understanding of the strengths of these intelligence success factors and their related KPIs firsthand. They’re the product of Valona’s commitment to helping businesses excel and make insight-driven decisions.

Apply these insights to your own organization! By focusing on intelligence success factors and regularly measuring your progress using KPIs, you’ll be world-class in no time.

Want to find out where you stand and which KPIs to track?

Start with the Intelligence Maturity Calculator, which will help you map out where your organization stands with each intelligence success factor!