The economy is lagging; invest in market research

Discover why investing in market research is crucial during economic downturns. As inflation, geopolitical tensions, and other challenges strain businesses, market research provides essential insights to boost efficiency, innovate, and strengthen customer relationships.

Introduction

When the economy lags, businesses face compound challenges like inflation, geopolitical tensions, cyber threats, and climate risks.

Yet, even amidst a bleak GDP growth outlook for 2024-2026, companies can not only survive–but thrive.

How?

By boosting efficiency, innovating, diversifying, and strengthening customer relationships.

Central to these strategies is investing in market research.

GDP growth rates are volatile right now

Global GDP has seen moderate growth over the decades, punctuated by notable downturns. During the 1980s, 1990s, and 2000s, GDP growth averaged 3–4% annually. Significant declines occurred in 1991 and 2009 due to the financial crisis, and again in 2020 due to the COVID-19 pandemic. The 2020s have been particularly volatile, with a sharp decline in 2020 followed by fluctuating growth rates.

The World Bank’s latest projections indicate a less optimistic outlook for 2024-2026, forecasting global growth to linger around 2.6–2.7%, below pre-COVID-19 averages. Developing and low-income economies might see modest growth, while advanced economies face stable but subdued expansion rates.

Barriers to global economic growth in 2024

Inflation and monetary tightening

After the sharp economic downturn caused by COVID-19, central banks worldwide took bold measures to ease monetary policy, slashing interest rates. Initially, inflation rates dropped due to reduced demand. However, as economies began to recover, inflation surged, driven primarily by supply chain disruptions.

In 2022, inflation soared to multi-decade highs, particularly in the U.S. and Europe, fueled by the war in Ukraine, ongoing supply chain issues, and high energy prices. In response, central banks, including the Federal Reserve and the European Central Bank, started tightening monetary policy by raising interest rates.

These actions led to a decline in inflation rates, from about 8.8% in 2022 to 6.8% in 2023, with projections of 5.9% in 2024 and 4.5% in 2025. Decreasing inflation might ease financial conditions, this is true. However, the overarching tightening of financial policies threatens economic slowdowns and debt distress, especially in emerging markets.

Geopolitical tensions

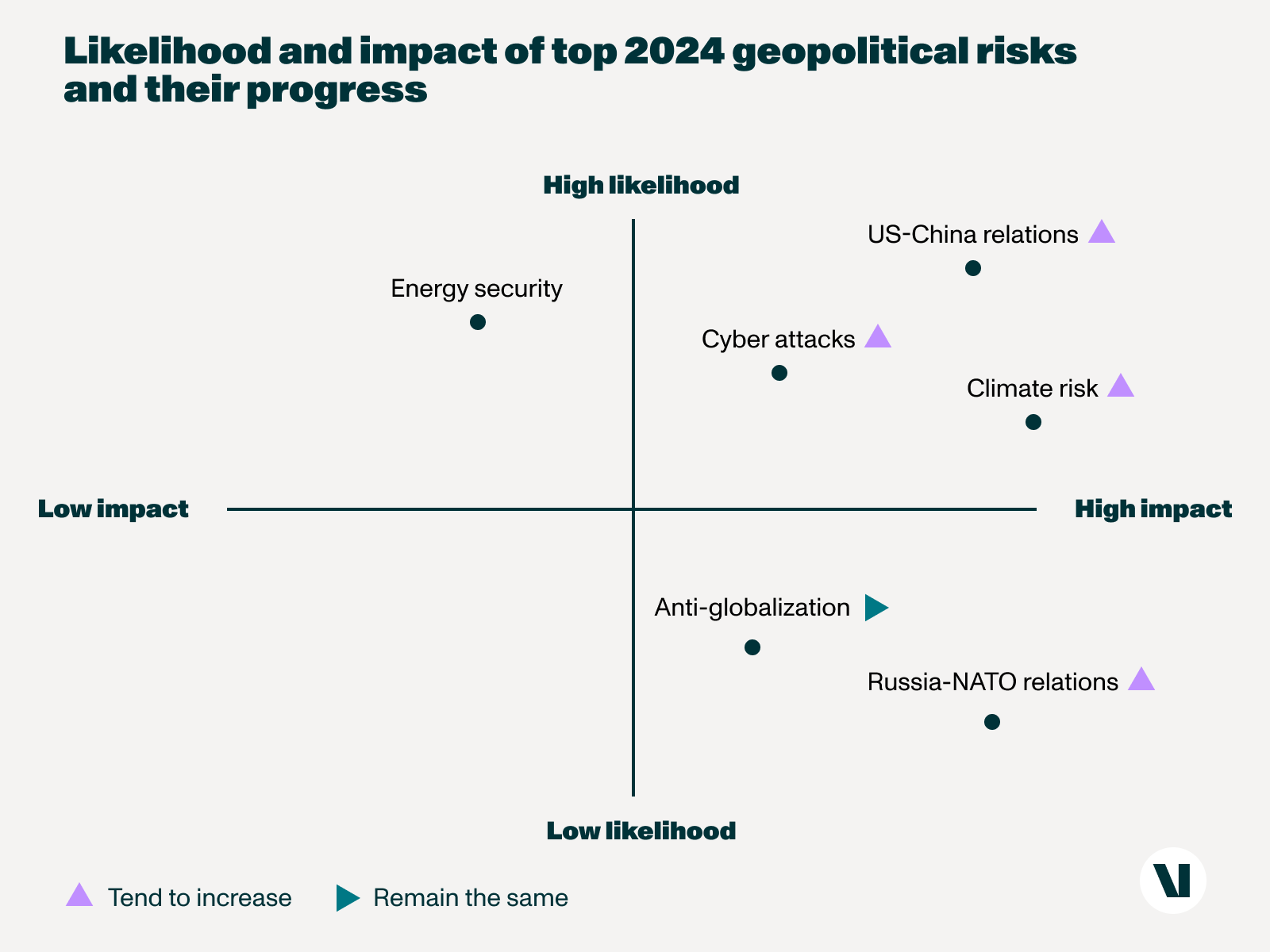

Geopolitical risks, including US-China relations, cyber attacks, and climate risks, profoundly impact global economic dynamics. These tensions affect growth, inflation, financial markets, and supply chains, posing considerable challenges for businesses.

US-China relations

China’s increased military presence in the South China Sea and ongoing trade tensions with the U.S. pose significant risks of escalation. These tensions escalated sharply in 2018 with U.S. tariffs on Chinese imports and further intensified with technology export restrictions by the U.S. in January 2020. Additionally, the growing liquefied natural gas (LNG) trade between the U.S. and China remains a critical factor in these strained relations.

Cyber attacks

The U.S. faces widespread ransomware attacks, prompting urgent calls for stricter safeguards. Recent cyber attacks have also targeted the European Parliament, Moldova’s government, and Australia’s Optus. The increasing digitization of critical infrastructure like power grids and water supply networks has heightened vulnerabilities to cyber attacks. Persistent cyber threats impact financial markets and the economy, putting both government and private sector networks at significant risk.

Climate risk

Climate change leads to more frequent and severe weather events, damaging infrastructure and disrupting supply chains. Water scarcity has raised geopolitical tensions in the Middle East and sub-Saharan Africa, disrupting operations and increasing food prices in South America. Efforts for geopolitical cooperation, crucial for addressing climate change, face resistance from fossil fuel-dependent countries, potentially leading to further tensions.

Russia-NATO relations

Tensions between NATO and Russia are at their highest since the Cold War, fueled by economic sanctions on Russia and NATO’s support for Ukraine. With no clear victory in sight and a ceasefire unlikely, the ongoing war continues to pose significant risks of escalation.

Energy security

Europe faces severe challenges after losing access to cheap Russian gas, leading to record-high gas prices and the reactivation of coal plants, which threatens the clean energy transition. Additionally, the digitization of the energy sector increases its vulnerability to cyberattacks, posing significant risks to critical infrastructure and energy supply.

Anti-globalization

The anti-globalization movement threatens economic growth. However, a trend towards pragmatism and cooperation is emerging, partly in response to Russia’s invasion of Ukraine. While protectionism remains a risk, global trade is expected to recover and return to stable growth by 2024.

How top enterprises respond to economic challenges

In State of the Consumer 2024: What’s now and what’s next, McKinsey highlights that companies can’t afford to rely on “yesterday’s consumer insights”.

Here’s how insights from market research help businesses navigate and even thrive during economic slowdowns:

Strengthen risk management

Market research identifies potential risks and challenges in the market. By understanding these risks, businesses can develop strategies to mitigate them, ensuring they remain resilient in uncertain times.

Due to the less positive global economic growth outlook, businesses are encountering various difficulties, especially reduced consumer spending, higher cost pressures, and challenges in securing investments and expansion.

Amazon, for example, faced significant risks due to rising operational costs and supply chain disruptions, exacerbated by the global economic slowdown and geopolitical uncertainties. Through extensive market research, Amazon identified the need to streamline its operations and enhance efficiency to mitigate these risks.

- Streamlined processes: Amazon Robotics significantly enhanced its global operations and boosted engineering efficiency by 35% using Amazon DynamoDB. This scalable database service allowed their engineers to focus on innovation rather than server management.

- Cost management: By understanding the cost pressures and operational inefficiencies, Amazon implemented cost-saving measures and optimized its supply chain, reducing waste and improving overall efficiency.

Identify new market opportunities

Even during economic downturns, growth opportunities exist if companies are well-informed. Market research uncovers new market segments, emerging trends, and unmet needs that businesses can capitalize on, enabling them to stay ahead of the curve.

- Diversify product offerings including more affordable options: Marks and Spencer, for example, adopted a “less is more” strategy by reducing their clothing and accessories ranges. They emphasize value and style rather than offering a wide variety of choices. This strategy allows them to appeal to budget-conscious consumers while still maintaining quality and attractiveness.

- Implement cost-cutting measures without compromising quality: Unilever has invested in energy-efficient technologies and streamlined its supply chain to minimize waste and decrease energy usage. This strategy not only reduces costs but also aligns with the company’s sustainability objectives.

- Focus on the essentials: During the 2008 recession, P&G used market research to identify which product categories were still considered essential by consumers and which were being cut back. They found that while consumers were cutting back on luxury items, they still valued quality in essential products like household cleaners and personal care items. P&G shifted its focus to these essential product categories, emphasizing quality and value by introducing value packs and larger sizes, which resonated with budget-conscious consumers.

- Adopt flexible pricing models to attract and retain customers: Microsoft has introduced a usage-based pricing model for its Azure cloud services. This approach bills customers according to their actual usage, making it more cost-effective for businesses of various sizes and promoting broader adoption of their cloud solutions.

Analyze competitors

By analyzing competitors, businesses can gain crucial insights into their strategies, strengths, and weaknesses, which helps them position themselves more effectively.

- Honeywell, a multinational conglomerate, used market research to navigate the Great Recession. They conducted extensive competitor analysis to understand how other companies in their industry were responding to the economic challenges. Honeywell identified opportunities to streamline operations and focus on core competencies. They also used market research to explore new market niches and potential products, which helped them stay competitive and emerge stronger post-recession.

Final thoughts

During economic downturns, businesses must focus on reducing costs, optimizing operations, and continuing investments in critical areas like market research. This investment enables companies to make informed, strategic decisions that drive sustained success even in challenging times.

Market research doesn’t just illuminate risks or opportunities; it provides a roadmap for navigating the complexities of a troubled economy. By staying informed and adaptable, businesses can not only survive but thrive, regardless of the economic landscape.

By the way, if you found this article useful or are interested in ways you can impact your organization, Valona hosts monthly community events and webinars. Check out these upcoming events to stay informed, engaged, and inspired!