What is market intelligence? A practical guide

Market intelligence means getting the right information to the right people at the right time to make better decisions. Here's how to do it.

Key points:

Introduction to market intelligence

$1.1 trillion. That’s how much the global market for big data analytics is projected to reach by 2032.

Why? Because data is knowledge, and knowledge is power.

But data alone isn’t enough to make your business succeed. You need to find the right data at the right time, then action it in a strategic and useful way. In other words, you need market intelligence.

What is market intelligence?

At its core, market intelligence means having the right information at the right time to make the right decisions. It’s about turning data into insights and using those insights to make better-informed decisions.

Tactical intelligence can make a real difference for your sales team. For example, knowing about a recent executive appointment by a prospective client allows your team to involve that new executive early in the sales process.

Operational intelligence is equally crucial. By monitoring shifts in your competitor’s messaging, you can adapt your campaigns to highlight unique features they overlook.

Strategic intelligence also plays a vital role. For instance: if a manufacturing company understands the development and adoption of assembly robotics, they are able to time their investments in new technologies.

With the sheer volume of raw information that we’re exposed to on a daily basis, it can be tough to filter out the noise and decipher what’s actually important for our business.

The pursuit of this information filtration became the market intelligence community. Given the complexity and rate of change in global markets, even the smallest companies need a robust understanding of market dynamics, competitor strategies, and customer needs.

Consider this:

94% of businesses say data and analytics are important to their digital transformation efforts; however, only 24% of companies consider themselves data-driven and even less believe they have a data culture.

So the question is: how do we fill the gap? In Valona’s opinion: that’s where market intelligence comes in.

Market intelligence gives you and your business:

- A clear view of where your market is heading, backed by data-driven, up-to-date forecasts

- Deeper insights into customer behavior (not just surface-level preferences)

- Predictive analysis of competitor strategies

- The ability to make decisions based on comprehensive, real-time data

As markets become increasingly interconnected and uber-competitive, companies must focus on market intelligence to stay ahead. It’s no longer a luxury but a necessity for survival and growth.

What does market intelligence involve?

Market intelligence is a comprehensive, ongoing process that combines various market intelligence data sources and methodologies to provide a 360-degree view of your business environment. It’s not just about understanding what’s happening now—it’s about predicting what’s coming next and positioning your business to thrive in future market conditions.

Difference between market intelligence and market research

There is a common misconception that market intelligence is just a fancy term for market research. Not quite. While we’d be lying if we said there isn’t some crossover, market research and market intelligence do serve different purposes.

Basically, if market research is the tool, market intelligence is the toolbox.

Market Research is typically project-based and time-bound (for example, market research that happens when bringing a new product to market), focused on answering specific questions, and often relies heavily on surveys and focus groups.

Market Intelligence is an ongoing and continuous monitoring practice that is built into the organization. It’s broader in scope, and covers multiple aspects of the market. It also uses a wider range of data sources and methodologies.

While market research might help you understand current customer preferences, market intelligence would combine that information with competitor analysis, trend forecasting, and other data to provide a basis for strategic decisions surrounding product development, market positioning, supply chain decisions, GTM strategy, and more.

For example:

- Market research might tell you that customers in a particular segment prefer product features A and B, because of an in-depth survey you conducted.

- Market intelligence would take that information, combine it with data on competitor products, emerging technologies, and market trends, and help you decide not just what features to include in your next product, but also how to position it in the market, what pricing strategy to use, and how to time your launch for maximum impact.

Why market intelligence?

Hopefully, the benefits of market intelligence are starting to become clear by now, but just in case, let’s go over a few benefits of market intelligence, and why your business should start your market intelligence journey today.

More informed decision-making: Market intelligence provides valuable data (like targeted studies, industry forecasting, and continuous competitor analysis) that goes above and beyond surface-level research, helping you make better strategic decisions.

Getting a competitive edge: Understanding market trends, competitor strategies, and customer preferences allows you to position your business more effectively.

Better risk management: Market intelligence (in particular, monitoring macroeconomic trends) helps identify potential industry or global challenges, allowing you to prepare and adapt your strategies proactively.

Enables growth and business development: By leveraging comprehensive insights into customer needs, market opportunities, and emerging trends, market intelligence helps businesses identify new areas for expansion, innovate effectively, and enhance their long-term growth potential.

More measurable results: Tangible benefits can be tracked using Key Performance Indicators (KPIs). As an idea, those KPIs in your organization could look like:

- Strategic alignment with company goals

- Impact on decision-making

- Progress toward business objectives

- Efficiency in completing tasks

- Quality and relevance of insights

- Accuracy of market predictions and analysis

Read more about how to measure market intelligence effectiveness with KPIs here.

6 types of market intelligence

As we’ve covered, market intelligence is a systematic approach to gathering, analyzing, and interpreting information about a market, including customers, competitors, and the overall economic environment.

What are the different types of market intelligence?

So then there’s the question: how does a company actually do market intelligence? First, it’s important to note that market intelligence can be split into many areas – but today we’ll just focus on a few.

- Competitive Intelligence

Competitive Intelligence (CI) involves analyzing your competitors’ strengths, weaknesses, and business strategies in an attempt to differentiate your business and gain market share. Battle cards are a practical example of competitive intelligence. - Product intelligence

This involves tracking product life cycles, pricing, and performance to promote innovation and keep your own offerings market-relevant. - Market understanding

Market understanding covers things like assessing market size, growth, trends, and segments. It also can help you identify emerging opportunities and potential threats. - Customer understanding

Examines customer attitudes, behaviors, and needs while improving product development and boosting long-term customer loyalty. - Supplier intelligence is about gathering and using insights on your suppliers to better understand their strengths, performance, and potential risks—it helps you build the foundations of strategic sourcing.

- Strategic foresight is the practice of exploring future trends and possibilities to help organizations anticipate change and make better long-term decisions. It helps you stay agile and prepare for potential (or inevitable) challenges before they happen.

Market research

Market research is an ongoing process that involves gathering all of the types of market intelligence to provide a comprehensive view of your business environment. It’s not just about collecting data—it’s about analyzing it, drawing insights, and using those insights to make big, scary decisions.

Key steps in the market intelligence research process:

- Define your intelligence needs

- Identify relevant data sources

- Collect and organize data

- Analyze data to derive insights

- Present findings in an actionable format

- Act on insights and measure results

Remember: the goal of market intelligence research is not just to gather information and sit on it, because that does very little for your business.

Instead, we want to provide insights and recommendations that your different business units can actually use.

For a deeper dive into market analysis, check out our guide on five easy steps to conducting one.

How to use market intelligence in your business operations

Now that we’ve covered the what and why of market intelligence, let’s explore the how. How can businesses leverage market intelligence to drive growth and stay competitive?

Let’s look at some use cases, both of Valona customers and a few brands you might be well-acquainted with already.

Entering new markets

Case study: Tesla enters the Chinese market

Not many global brands have been able to penetrate the Chinese market. The graveyard of fallen global superbrands includes Walmart, Uber, Amazon, Home Depot, Groupon and more.

However, Tesla used extensive market intelligence to navigate China’s notoriously complex automotive market. They analyzed local consumer preferences, regulatory environment, and competitive landscape and ended up on top. Now, China accounts for 22.5% of its global revenue, even with the emergence of dozens of new local EV competitors.

Key takeaway: Thorough market intelligence can turn a challenging new market into a major growth driver.

For more insights on evaluating market attractiveness, visit Valona’s market attractiveness service page.

Product launch and enhancement

Coca-Cola used market intelligence to successfully launch Coca-Cola Zero Sugar, or Coke Zero. Here’s how:

Case study: Coca-Cola launches Coke Zero

- Understanding their target audience: Research revealed that younger consumers were interested in low-calorie beverages but weren’t keen on Diet Coke, which was more popular among older demographics.

- Product innovation: Feedback from taste tests showed that Diet Coke’s taste was a barrier. Coca-Cola responded by creating a new formula that matched the taste of classic Coca-Cola while remaining sugar-free, directly addressing consumer preferences.

- Rebranding to appeal to said target audience: Market intelligence showed that the term “diet” didn’t resonate with the younger audience, who were pushing back against 2000’s diet culture. To counter this, Coca-Cola branded the product as “Zero Sugar,” focusing more on the absence of sugar rather than weight loss, which had a more modern, health-friendly appeal.

- Strategic launch and marketing: Coca-Cola used data to identify key demographics and regions where health-conscious consumers were more likely to adopt the product. This intelligence informed digital marketing strategies and campaigns that emphasized lifestyle, taste, and zero sugar.

As a result, Coca-Cola Zero Sugar achieved significant success globally, effectively reaching younger and health-conscious consumers, and cementing Coca-Cola’s position in the low-calorie beverage market.

Takeaway: Market intelligence can help your business launch or, as in the case of Coca-Cola, enhance an existing product to appeal to a more lucrative demographic.

Growing market share

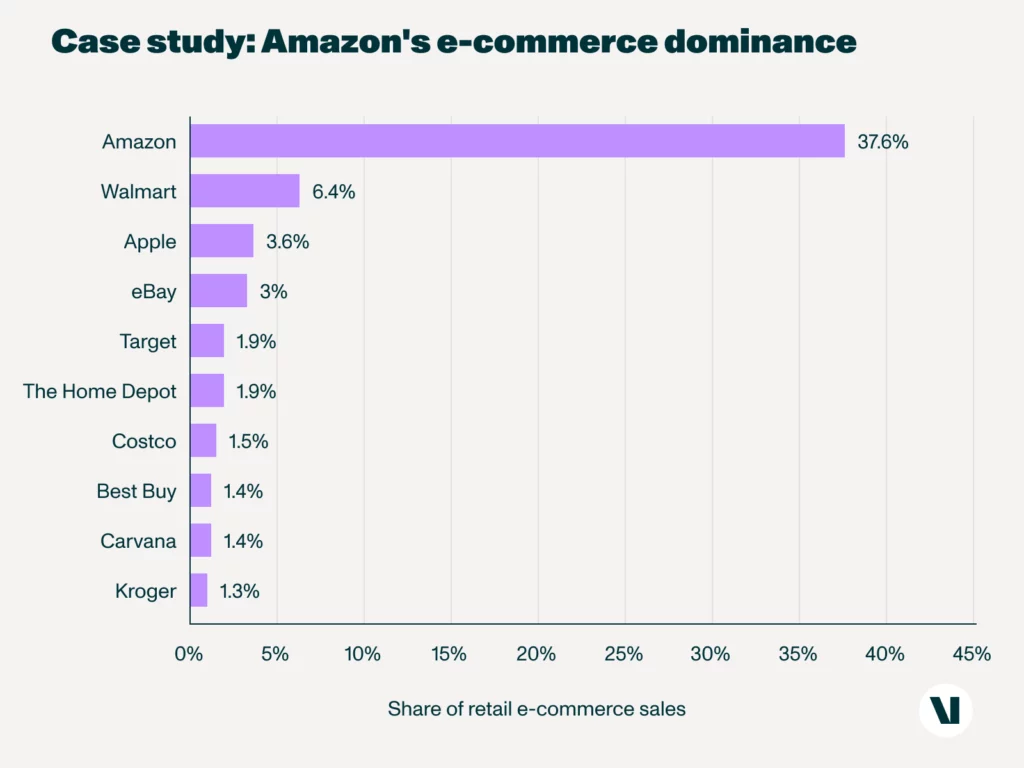

Amazon uses sophisticated market intelligence to continuously optimize its offerings and stay ahead of competitors.

The ecommerce giant holds a massive 38% market share in the US, followed not even closely by Walmart and Apple. In fact, they’re set to reach 50% market share by the end of 2024.

Case study: Amazon’s e-commerce dominance

But what does market intelligence have to do with it?

Amazon has strategically used Business Intelligence (BI) and Market Intelligence in several key areas:

- Forecasting and inventory management based on global trends

- Product recommendations based on pop culture and demographic trends

- Market demand adaptation

- New product and service lines

The key takeaway: Complementing your BI efforts with market intelligence is key to maintaining and growing market share in ultra-competitive industries like ecommerce.

Identifying M&A and joint venture opportunities

Growth doesn’t always have to be organic. For companies who are on the lookout to absorb the competition or broaden their service offering, market intelligence can help you spot lucrative M&A and partnership opportunities before your competitors.

Case study: Microsoft’s acquisition of LinkedIn

Microsoft used market intelligence to identify LinkedIn as a strategic acquisition target, complementing its existing products and opening new market opportunities. LinkedIn wasn’t a competitor, but an opportunity for growth.

And it’s paying dividends for Microsoft – LinkedIn’s revenue has risen from $2.3 billion at acquisition time in 2015 to $15 billion in 2024. It not only benefited Microsoft revenue-wise, but now the company has the strongest foothold in professional networking and B2B advertising markets.

Key takeaway: Market intelligence can help identify synergistic acquisition opportunities that drive significant brand and revenue growth.

Anticipating competitor threats

In business, surprises aren’t usually good news. Market intelligence helps you see what’s coming before your competitors do.

Case study: Netflix’s shift to original content

In 2013, Netflix produced its first original series, House of Cards. Around that time, the streaming service had about 33 million subscribers worldwide. This year, that number climbed to 277 million.

So how did they do it?

Well, of course we can’t reduce it down to one factor, however, being first to the trend of original content surely has a large part to do with it.

Netflix used market intelligence to anticipate the trend towards original content and potential threats from content providers launching their own streaming services.

The results? Netflix still reigns supreme in producing the most original series content of any other network or streaming service. Long live The Crown.

Key takeaway: Market intelligence can help you anticipate and respond to competitive threats before they materialize.For more insights on competitive intelligence, check out our practical guide to competitive intelligence.

Reducing operational risks and securing supply chain management

There’s not a company on earth that can avoid risk—it’s just a part of business (and life). Risks can come from unexpected places, but market intelligence can help you peek around corners.

Particularly in the case of supply chain management, companies that use market intelligence are more likely to stay ahead of:

- Regulatory shifts

- Fluctuations in raw material costs

- Threats to the market

- Threats to their suppliers

- Competitors’ new supplier partnerships

Key takeaway: when your business operates in a volatile market with many intermediate goods and services, market intelligence is an indispensable tool to keep your operational risks low and supply chain safe.

Improving marketing and sales

Case study: A leading Nordic manufacturing company

A leading Nordic manufacturing company with a global sales team was struggling to gather key sales leads from their target international markets, like Brazil.

So how did market intelligence help?

Using Valona’s market intelligence solution, regional sales teams were delivered timely alerts from diverse markets. These leads included details on plant expansions, investments, upgrades, and partnerships, conveniently translated into English.

With access to insights from specialized manufacturing sources, comprehensive reports, and local newspapers, the platform delivered valuable English-translated data, expanding the customer’s global reach and introducing them to new leads.

They were able to completely change the way they did lead generation, with over 500 quality leads generated within the first 3 months of using market intelligence with Valona.

Key takeaway: Sometimes, the difference between success and failure is just having the right information at the right time.

Market intelligence tools

Having the right tools can make all the difference to your market intelligence function. In this section, we’ll go over what kinds of market intelligence tools are available on the market and how to consider which is right for you.

Overview of market intelligence tools

Market intelligence tools are software solutions designed to collect, analyze, and visualize market data. They range from simple data aggregators to sophisticated AI-powered platforms that provide predictive insights.

Key features often include:

- Data collection from multiple sources

- Advanced analytics and visualization

- Customizable dashboards and reports

- Integration with other business systems (Shared workspaces, CRM, BI, ERP, etc.)

These tools help businesses streamline their market intelligence processes, making it easier to gather, analyze, and act on market data quickly and efficiently.

Types of market intelligence tools

There’s a wide variety of market intelligence tools out there. Some companies choose to purchase a different license for several solutions. Here are some common types:

- All-in-one Market Intelligence platforms: combine multiple functionalities for a holistic approach to market intelligence. They often include features from all the categories below, providing a single source of truth for a company’s market intelligence needs. Higher-quality platforms generally provide real-time data and don’t rely on dated or imported data.

- Competitive intelligence platforms focus on tracking and analyzing competitor activities. They often include features like automated web scraping, social media monitoring, and competitor benchmarking.

- Social listening tools monitor social media and online forums for brand mentions and customer sentiment. They can help businesses understand public perceptions of their brands and products and identify emerging trends.

- Market research platforms provide access to industry reports and consumer surveys. They often include features for creating and distributing custom surveys, as well as tools for analyzing survey results.

- Predictive analytics platforms use advanced algorithms to forecast market trends and consumer behavior. They often leverage machine learning and AI to provide forward-looking insights.

- DIY or in-house platforms configured by analysts using free monitoring tools like Google Alerts and Trends, Sharepoint, and their intranet for creating dashboards. Typically updated manually.

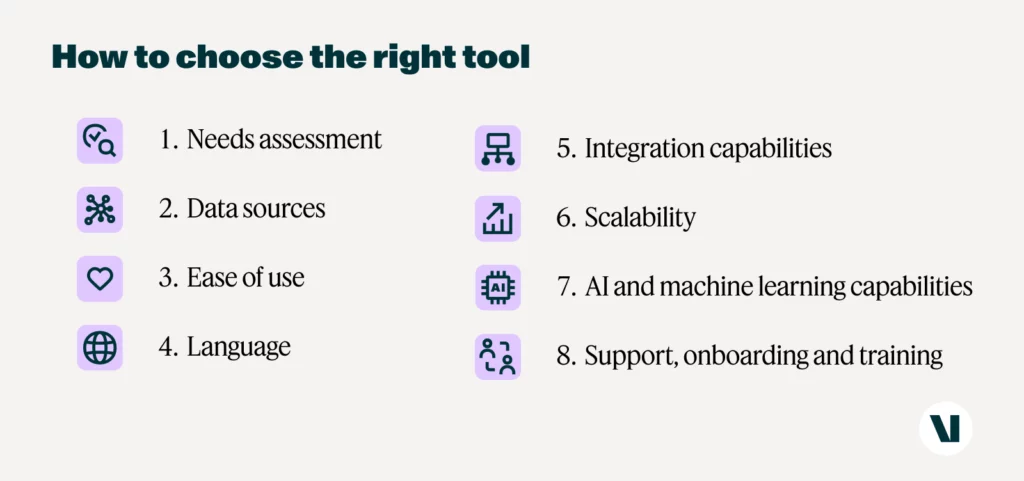

How to choose the right tool for your needs

With so many options available, how do you choose the right market intelligence tool for your business? Like any other software, it comes down to your internal resourcing and needs, now and in the future.

- Needs assessment: What kind of intelligence are you looking for? Competitor tracking? Consumer insights? Trend forecasting? Local insights from different markets? Field intelligence from your own teams? Regulatory monitoring? Learn more about the top 5 methods for gathering market intelligence.

- Data sources: Does the tool provide access to the data sources most relevant to your industry? Does it support real-time monitoring?

- Ease of use: Is the tool user-friendly? Will your team need extensive training? What kind of sharing and engagement features does it offer?

- Languages: What language sources does it monitor? Can you get by with only English language sources?

- Integration capabilities: Can it integrate with your existing stack of tools and technology?

- Scalability: Can the tool grow with your business? And serve the needs of different business functions?

- AI and machine learning capabilities: Does the tool leverage advanced technologies for deeper insights?

- Support, onboarding, and training: What kind of support does the vendor offer?

How to get started with market intelligence

Market intelligence isn’t just a nice-to-have—it’s the most efficient way to stay competitive. But remember, it’s not about having the most data. It’s about having the right data and knowing how to use it.

Here’s how you can start doing market intelligence (or if you already are, doing it more effectively):

Make it an ongoing process.

Market intelligence isn’t a one-time effort—it’s a continuous cycle of gathering, analyzing, and acting on information. Set up regular review processes to ensure you’re continuously updating and acting on your market intelligence.

Assess your current capabilities.

Take the Valona Intelligence Maturity Calculator to see where you stand and identify areas for improvement. This tool will help you understand your current market intelligence capabilities and provide a roadmap for improvement.

Start with a specific business challenge.

Where could better information make the biggest difference right now? Perhaps you’re considering entering a new market, launching a new product, or trying to increase your market share. Focus your initial market intelligence efforts on addressing this challenge, and use it to measure your intelligence success.

Foster a data-driven culture.

Encourage your team to base decisions on data and insights, not just intuition. This might involve training sessions, regular data-sharing meetings, or incorporating data-driven decision-making into your company values.

Invest in the right tools.

Choose market intelligence solutions that fit your specific needs and integrate with your existing processes. Again, the most expensive or feature-rich tool isn’t always the best choice—it’s about finding the right fit for your organization.

About Valona

We help businesses turn data into real, measurable impact.

Our AI-powered platform is designed to give you the insights you need, when you need them, in a format you can actually use. We combine advanced technology with expert human analysis to deliver actionable intelligence that grows your business.

Some features our customers love:

- An advanced AI research assistant

- Real-time competitor analysis and tracking

- AI-powered trend forecasting

- Customizable dashboards and reports

- Integration with your existing business systems

- Expert support and training

The future belongs to those who can see it coming. With the right market intelligence, that future can be yours.

The first step is understanding where you stand. Take the Valona Intelligence Maturity Calculator today and start working towards becoming a more informed, more agile, and more successful business.